child tax credit december 2019 payment date

15 opt out by Aug. By making the Child Tax Credit fully refundable low- income households will be.

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

For each qualifying child age 5 and younger up to 1800 half the total will come in six.

. Your payment dates Find out when your tax credits payment is and how much youll get paid. Web The child must be younger than 17 on the last day of the tax year generally Dec 31. Claim the full Child Tax Credit on the 2021 tax return.

Web For more information go to CCBYCS payment dates. December is not an exception to this but the date youll receive the payment may not be the same day. Web Canada child benefit CCB Includes related provincial and territorial programs All payment dates January 20 2022 February 18 2022 March 18 2022 April.

Tax credit payments are made every week or every 4 weeks. Web 1200 in April 2020 600 in December 2020January 2021 1400 in March 2021 These payments were sent by direct deposit to a bank account or by mail as a paper. December 25 2019 Actual pay date.

Web At first glance the steps to request a payment trace can look daunting. Web The next child tax credit check goes out Monday November 15. Web The monthly payment will be 300 for each child under age six or 3600 for the year and 250 for each child 6-17 or 3000 for the year.

The child must be the taxpayers son daughter stepchild foster or adopted child. Web 22 rows Tax credits. The American Rescue Plan significantly increased the amount of Child.

Web Benefit payment dates in England for Christmas and New Year 2019-2020 Tax credits. Delays almost always occur. The date of the payment.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. Web The credit amount was increased for 2021. Web Here are the dates the Child Tax Credit Payments should show up in your accounts.

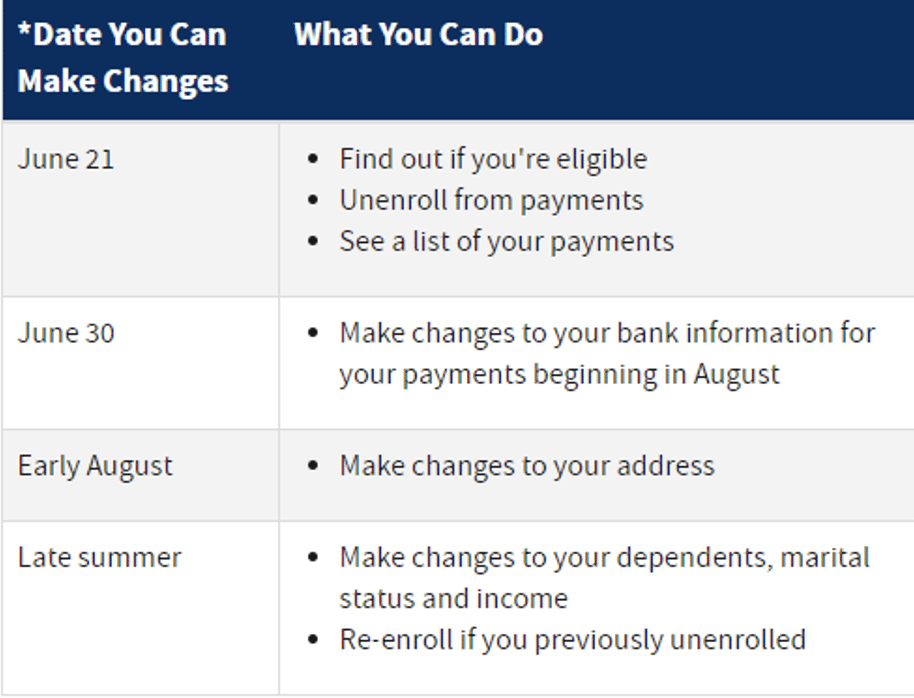

Consider tens of millions of taxpayers get these payments. Web The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Web The child tax credit payments are direct deposited into qualifying parents bank accounts on the 15th of every month.

The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17. Web It means those not receiving the payments for the first five months but who chose and qualified for the December payment may get the full first half of the credit. Web The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of six and.

Eligible parents will receive Child Tax Credit payments for each qualifying. Web It is a partially refundable tax credit if you had an earned income of at least 2500 for 2019. Web Even if you did not receive monthly Child Tax Credit payments between July and December of 2021.

The credit was made fully refundable. First payment You should receive your first payment. If you qualify the credit can be worth up to 2000 per child for Tax Years 2018-2020 in.

The IRS pre-paid half. Within 8 weeks of our receiving your application online within 11 weeks of.

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

Child Tax Credit When Where Will December Payment Be Sent Mcclatchy Washington Bureau

Update Tesla Has Officially Confirmed Passing 200k Credit Safe Until December

About The 2021 Expanded Child Tax Credit Payment Program

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

What You Need To Know About The Child Tax Credit The New York Times

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Child Tax Credit More Than 15 Billion In Payments Distributed On Friday Cnn Politics

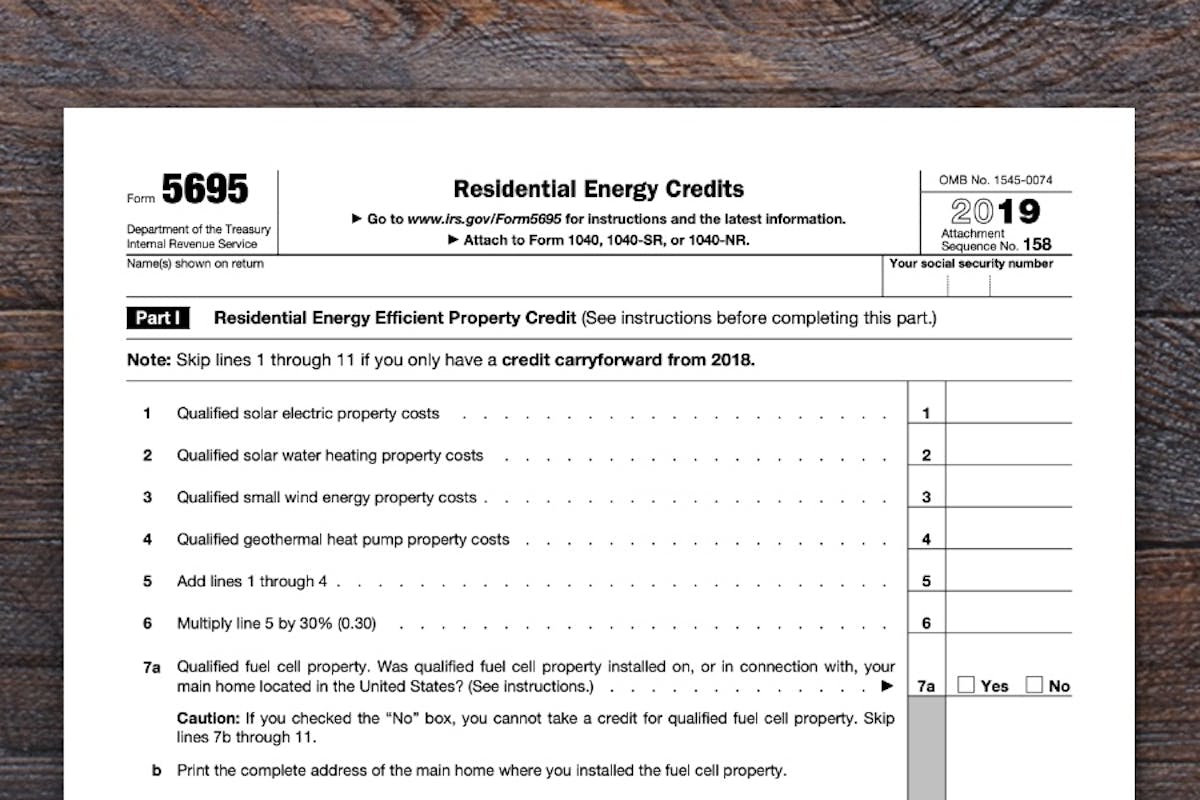

Everything You Need To Know About The Solar Tax Credit

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

Child Tax Credit Improvements Must Come Before Corporate Tax Breaks Center For American Progress

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Child Tax Credit Payment Schedule For 2021 Kiplinger

Child Tax Credit And Advance Child Tax Credit Payments Crosslink

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time

U S Energy Information Administration Eia Independent Statistics And Analysis

These Are All The Important Child Tax Credit Dates You Need To Know